bear trap stock example

In general a bear trap is a technical. A typical bear trap works like this.

What Is Bear Trap Trading And How Does It Work

In significant bear trap trading scenarios a bear trap.

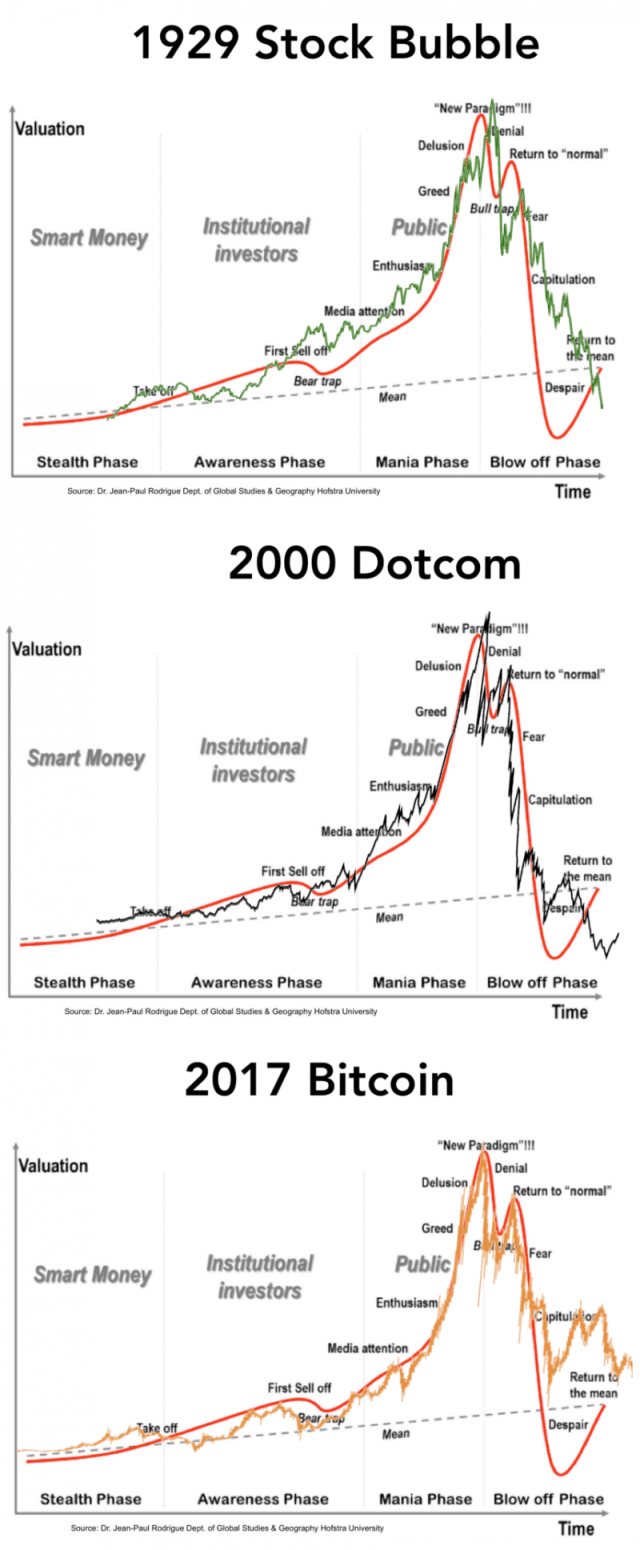

. Bear Trap Example. Essentially its a relatively sudden movement in a stock or in the broad market that lures in. A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in fact the security will continue to decline.

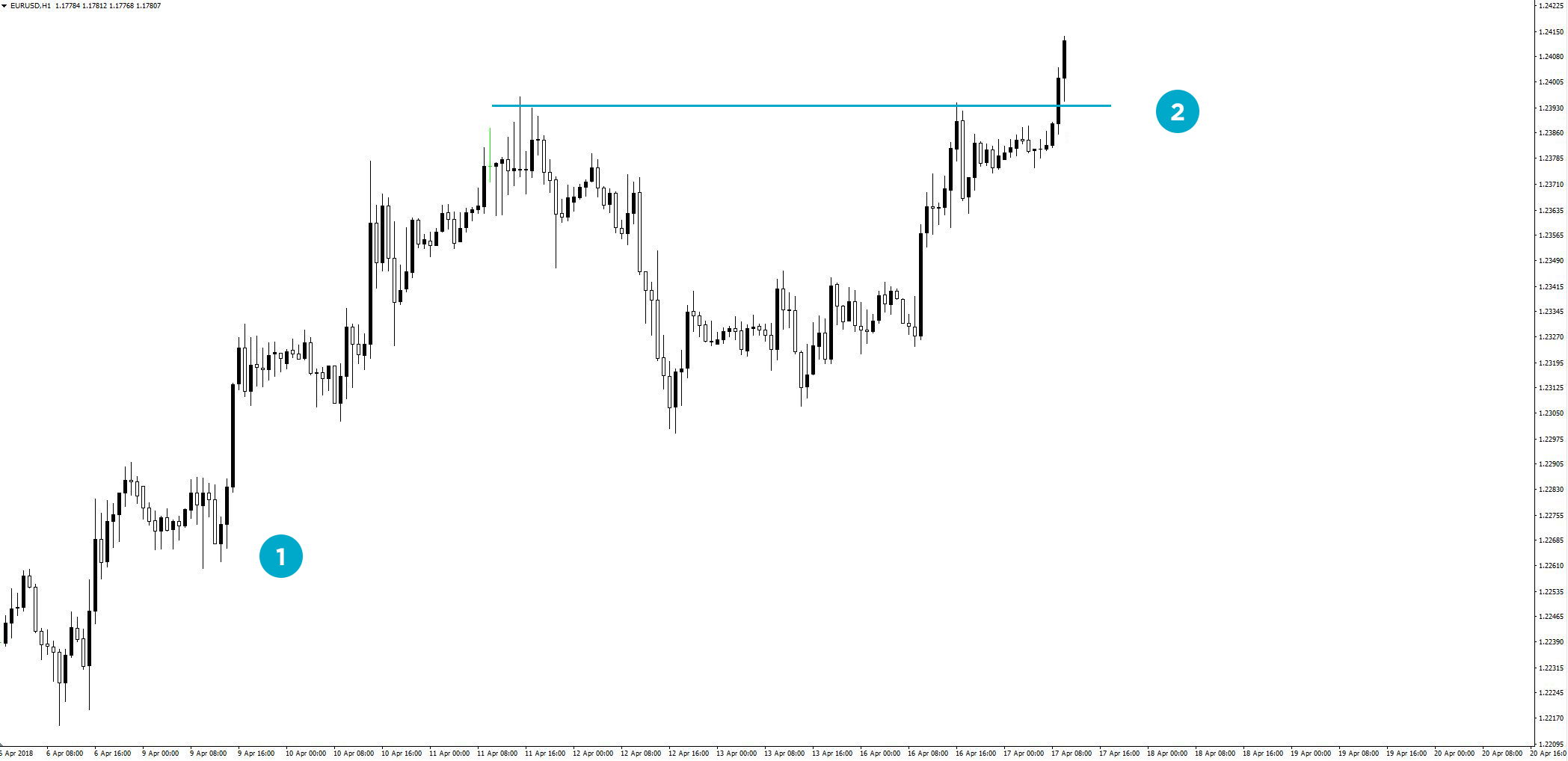

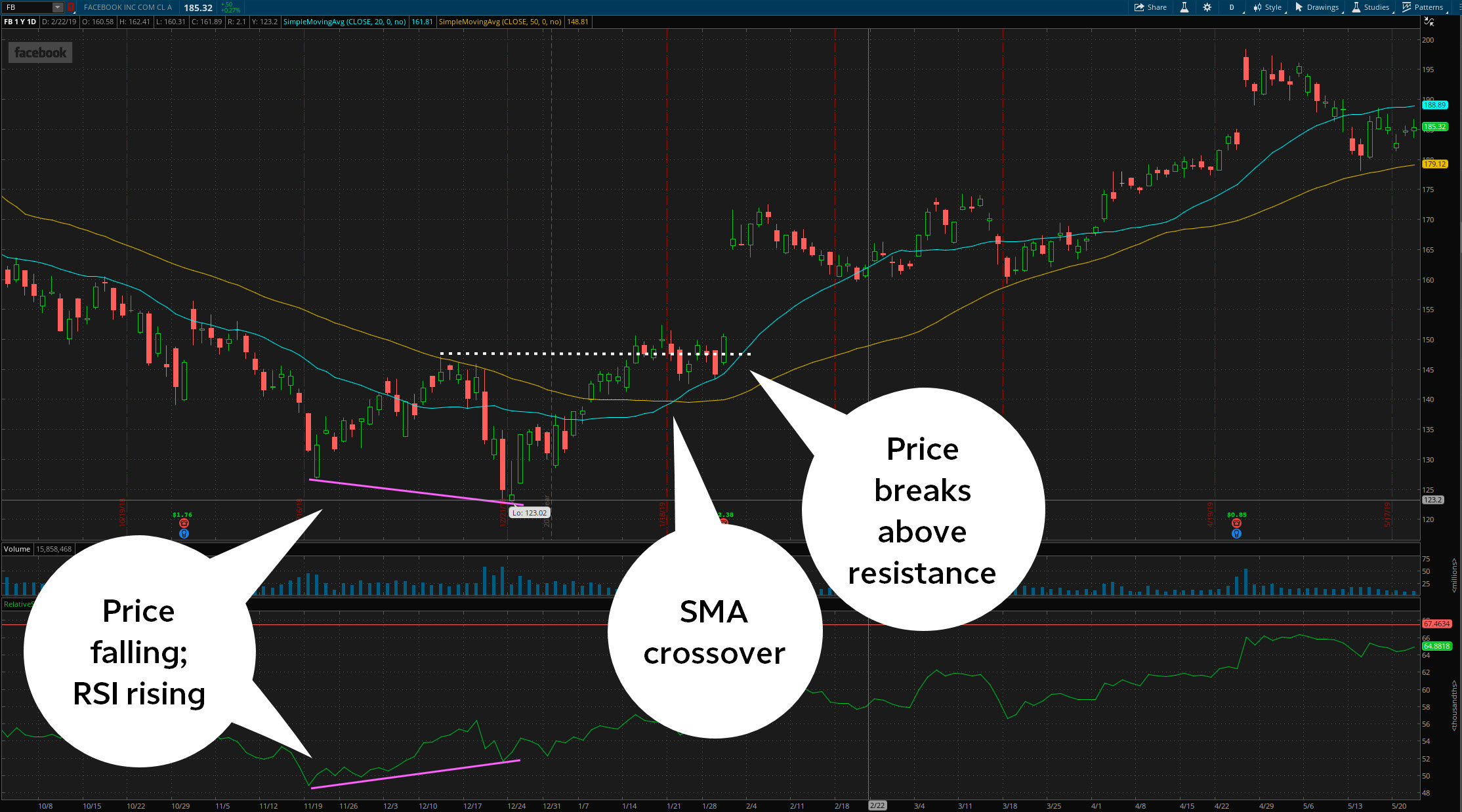

See real-life trade examples that illustrate how to identify the Bear Trap setup and profit from short squeezes. A bear trap in trading is a technical reversal pattern at the bottom. The pattern gives a false signal for the continuation of the downtrend encouraging traders to open short positions.

Novice traders start selling their stocks at a much lower. You will notice that the stock broke to fresh two-day lows before having a sharp counter move higher. In 2021 many investors found themselves caught.

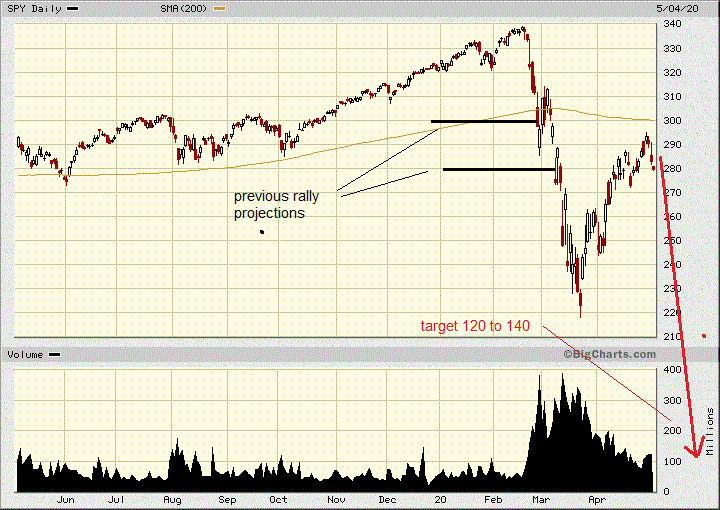

A bear trap is a temporary but sudden downtrend occurring after a long-term uptrend and quickly followed by a sharp rally of the stock. Below is an example of a bear trap on 76 for the stock Agrium Inc. Bear traps occur when investors bet on a stocks price to fall but it rises instead.

Imagine were in the middle of a bull market and youre one of the inexperienced traders looking to cash in on your. In this example you can see that the retail investor took a short position thinking that the stock price will continue declining but fell into a bear trap. Bear Trap into a Short Squeeze.

Example of a Bear Trap Stock in Action Throughout the COVID-19 pandemic energy company stocks were volatile and difficult to predict. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. Bear Trap Example Tesla stock has gone from 1 to over 500 times that price in just five years.

A bear trap is a colloquial name for a particular trading pattern in the stock market. Identify Bull Traps and Bear Traps with Relative Strength Index RSI One way to identify a potential bull or bear trap is by calculating the relative strength index RSI of the. Rising stock prices cause losses for bearish investors who are now trapped.

And the best way for investors like Jim Chanos and David Einhorn who are. A bear trap is a term that. Investors and traders take short positions.

A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside. For example intraday in forex markets or over several trading periods in the stock market.

Bear Trap Meaning What It Is And How Do Bear Traps Work

What Is A Bull Trap In Trading And How To Avoid It Ig International

The Bear Trap Everything You Ve Ever Wanted To Know About It Earn2trade Blog

Who Said Traders And Investor Are Emotional Right Now

The Bull Trap Trading Strategy Guide

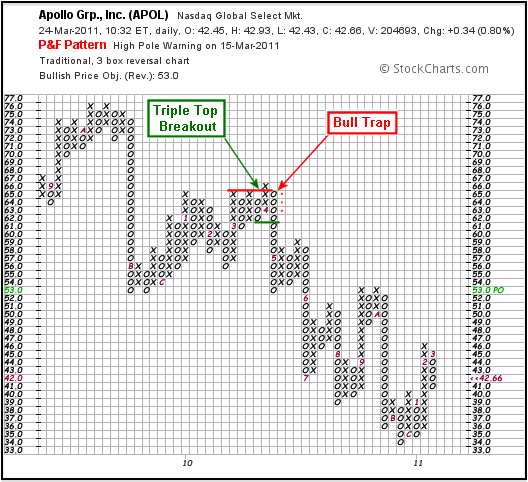

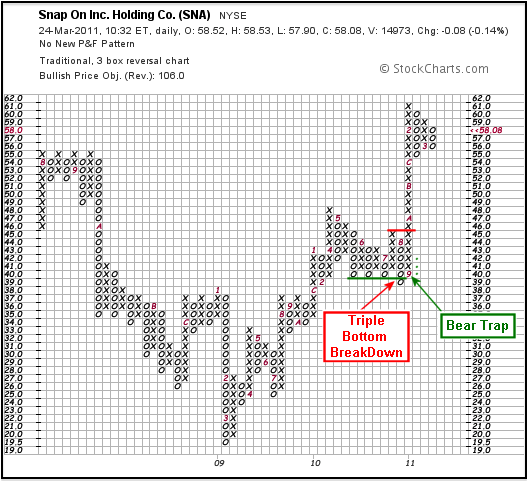

P F Bull Bear Traps Chartschool

Bear Trap Explained For Beginners Warrior Trading

Is Stock Market Rise A Bear Market Trap Or New Bull Market

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

P F Bull Bear Traps Chartschool

Bull Bear Traps Trading Strategies 26 September 2019 Traders Blogs

What Is A Bear Trap On The Stock Market Fx Leaders

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

The Great Bear Trap Bull Trap Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_Final_Bull_Trap_Oct_2020-01-61dfe0dd8e584f1ca279a4bfb5f72eba.jpg)